What is SAP ICMR?

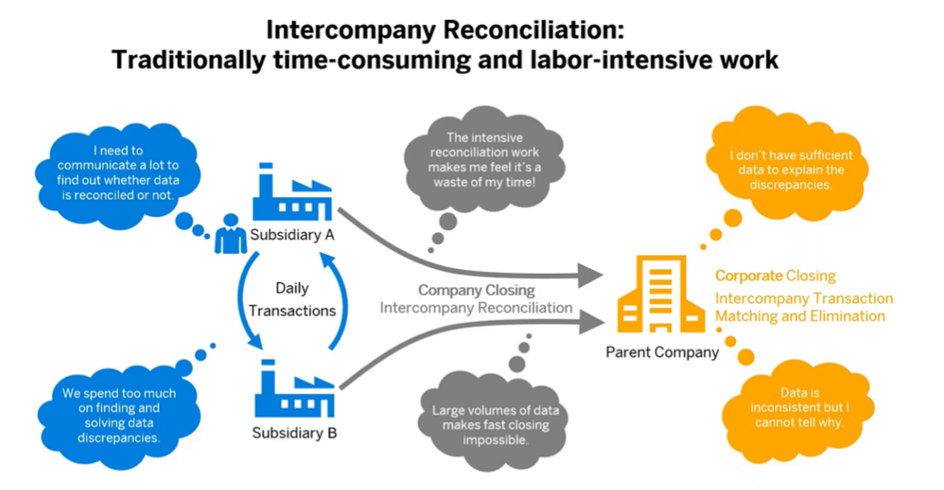

In the business world, it is essential to maintain a smooth and efficient cash flow. One of the key aspects of this is intercompany transactions, which involve the exchange of goods, services, or money between different entities within the same organization. However, with multiple transactions occurring simultaneously, it can become challenging to keep track of all the activities and ensure that everything balances out. This is where SAP ICMR, or Intercompany Matching and Reconciliation, comes into play.

What is SAP ICMR?

SAP S/4HANA’s ICMR (Intercompany Matching & Reconciliation) functionality introduced from 1909 in On-premise versions and 1908 for Cloud versions that helps automate the process of matching and reconciling intercompany transactions. It enables organizations to quickly and accurately reconcile financial transactions between different entities, business units, and legal entities.

How does SAP ICMR work?

It works by reconciling two transactions that have been posted to different entities, such as an accounts payable transaction in one company code and an accounts receivable transaction in another. The module matches the two transactions based on specific criteria, such as the invoice number (reference field), vendor or customer name, the amount and so on.

Once the transactions are matched, SAP ICMR flags any discrepancies that may exist, such as an invoice that has been paid in one company code but not yet received in another. The module then enables the parties involved to resolve the discrepancies and ensure that the books balance correctly.

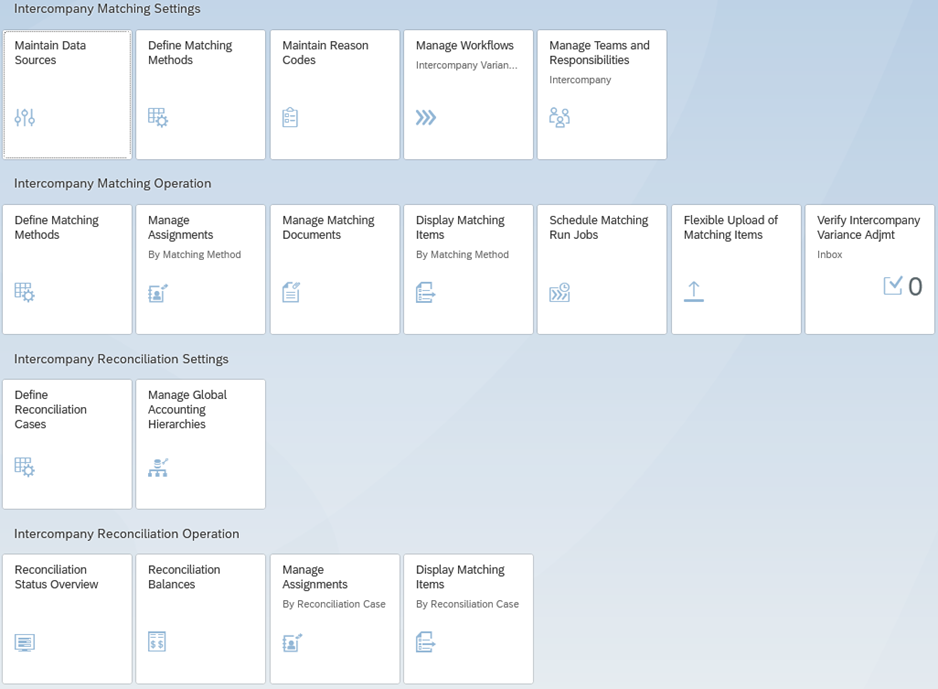

The New ICMR consists of:

1. Matching: Deals with transactional-level matching

2. Reconciliation: presents an aggregation-level view

3. Automatic Posting: function for variance adjustment, accrual and elimination postings.

In order to implement this, matching methods should be defined first.

Benefits of SAP ICMR

SAP ICMR offers several benefits to organizations, including:

- By automating the process of intercompany matching and reconciliation, SAP ICMR reduces the time and effort required to manually match and reconcile transactions.

- Ensures that all transactions are accurately matched, reducing the risk of errors that can lead to financial discrepancies.

- It provides real-time visibility into the status of intercompany transactions, enabling organizations to identify and resolve issues quickly.

- Centralized platform for managing intercompany transactions, allowing organizations to enforce control over the process.

SAP ICMR related Fiori App’s

In a nutshell, without ICMR functionality, the reconciliation of account balances and items between partner companies may become a difficult and time-consuming activity during period-end closing. It is an essential tool for organizations that engage in intercompany transactions. The process of matching and reconciling transactions is streamlined, lowering the chance of error and guaranteeing that the books balance. Organizations can increase their efficiency, accuracy, visibility, and control over intercompany transactions by utilizing SAP ICMR, which will ultimately result in a more streamlined and effective cash flow.